Texas Education Freedom Accounts (TEFAs) are a new education savings account program created by the Texas Legislature in 2025 (Senate Bill 2). It provides eligible families with state-funded education dollars that may be used toward private school tuition.

The following FAQs unpack the details of SB2, explain how the TEFA program works, and outlines how Regents is preparing to participate while staying true to our calling.

“School choice,” sometimes called “parental choice,” is the idea that parents should have the freedom to direct their children’s education – whether through public school, private school, homeschooling, or other models. Until now, Texas families who desired private education often had to make difficult financial sacrifices. With SB2, the state acknowledges that every family deserves access to the educational setting that best meets their child’s needs.

SB2 sets aside $1 billion to fund TEFAs for eligible families. Unlike traditional “school vouchers,” which are limited to private schools, TEFAs are more flexible. Funds can be used not only for private school tuition but also for homeschooling resources, tutoring, and other approved educational expenses.

December 2025: Schools decide whether to opt in and apply to participate. Only accredited private schools in operation for at least two years are eligible.

February 2026: Applications open for families.

March-May 2026: Families are notified whether they qualify and how much funding they will receive.

July 2026: TEFA funds begin applying to tuition and other expenses for the 2026-2027 school year.

This means parents interested in private school options should begin exploring now, before applications open.

- Students with Disabilities or Special Needs

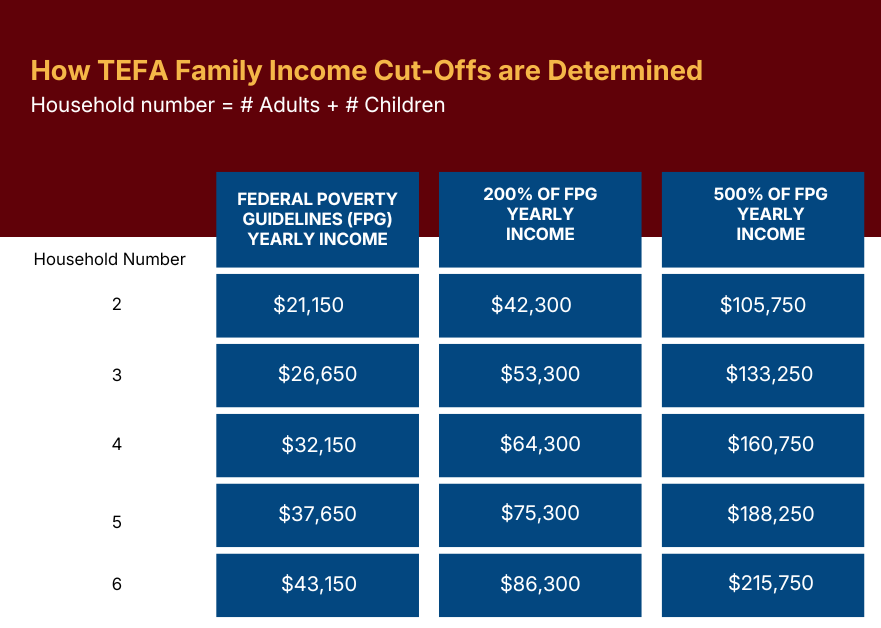

- Families earning less than 500% FPL.

- An Individualized Education Plan (IEP) or diagnosis from a qualified professional (like a licensed diagnostician) is needed to qualify for this category.

- Must have an IEP in place if parents want to qualify for additional funds beyond the $10,500-$12,000 annually.

- May receive up to $30,000 per year depending on need.

- Low-Income Families

- Families earning less than 200% FPL.

- Students may receive between $10,500-$12,000 annually.

- Middle-Income Families

- Families earning less than 500% FPL.

- Students may receive between $10,500-$12,000 annually.

- Higher-Income Families

- Households earning above 500% FPL.

- Still eligible, but priority is given first to students not already in private school.

Homeschool families are also eligible, though the award is smaller – typically up to $2000 per child per year.

Importantly, once a family qualifies and is awarded fund, they do not have to reapply each year. The support automatically rolls forward , making it a stable, predictable benefit.

All families interested in TEFA funding will apply at the same time when the application window opens in February 2026. The state will then review applications and determine eligibility.

Here’s what to expect:

Step 1: Apply – Parents submit an application through the state’s TEFA portal in February 2026.

Step 2: Provide financial documents – Families will likely need to upload their most recently filed IRS tax return (2024 return if the 2025 return is not yet filed). The state will use this to verify household income.

Step 3: Sorting into priority groups – The state will place families into one of the four categories (students with disabilities, low-income, middle-income, or higher-income).

Step 4: Notification – By March-May 2026, families will be informed whether they qualify and what funding amount they are awarded.

Families do not need to prove eligibility in advance — the determination happens after applying. Once awarded, TEFA funding rolls forward annually as long as eligibility requirements are met.

Understandably, many private schools are cautious about how TEFA funding might affect their independence. SB2 includes strong protections:

- Religious autonomy is preserved. Schools are not required to change their beliefs, curriculum, or policies to participate.

- Testing requirements remain flexible. Schools must provide “norm-referenced” testing (such as CLT, PSAT, SAT/ACT) but are not required to use the state’s STAAR test.

- Admissions remain independent. Private schools retain full control over admissions decisions and are not obligated to accept every TEFA recipient.

This ensures that schools like Regents can embrace TEFA opportunities without compromising mission or culture.

If you are a parent interested in your options, here are a few steps to take now:

1. Learn About the TEFA Program – Understand the eligibility tiers and whether your family may qualify.

2. Research Accredited Schools – Only schools accredited for at least two years can participate. (Regents meets both criteria.)

3. Start the Admissions Process Early – Schools like Regents often have limited space. Waiting until TEFA funds are distributed could mean missing available spots.

4. Stay Informed on Deadlines – Applications for families will open on February 4, 2026 and close on March 17, 2026. Award notifications to families will go out the week of April 6th.

5. Ask Questions – Contact schools directly to understand how they are participating and what their admissions requirements are.

Click to find out more information about Texas Education Freedom Accounts.